Why B2B Sub-Trades Need a Built-In B2C Redundancy

5 minute read

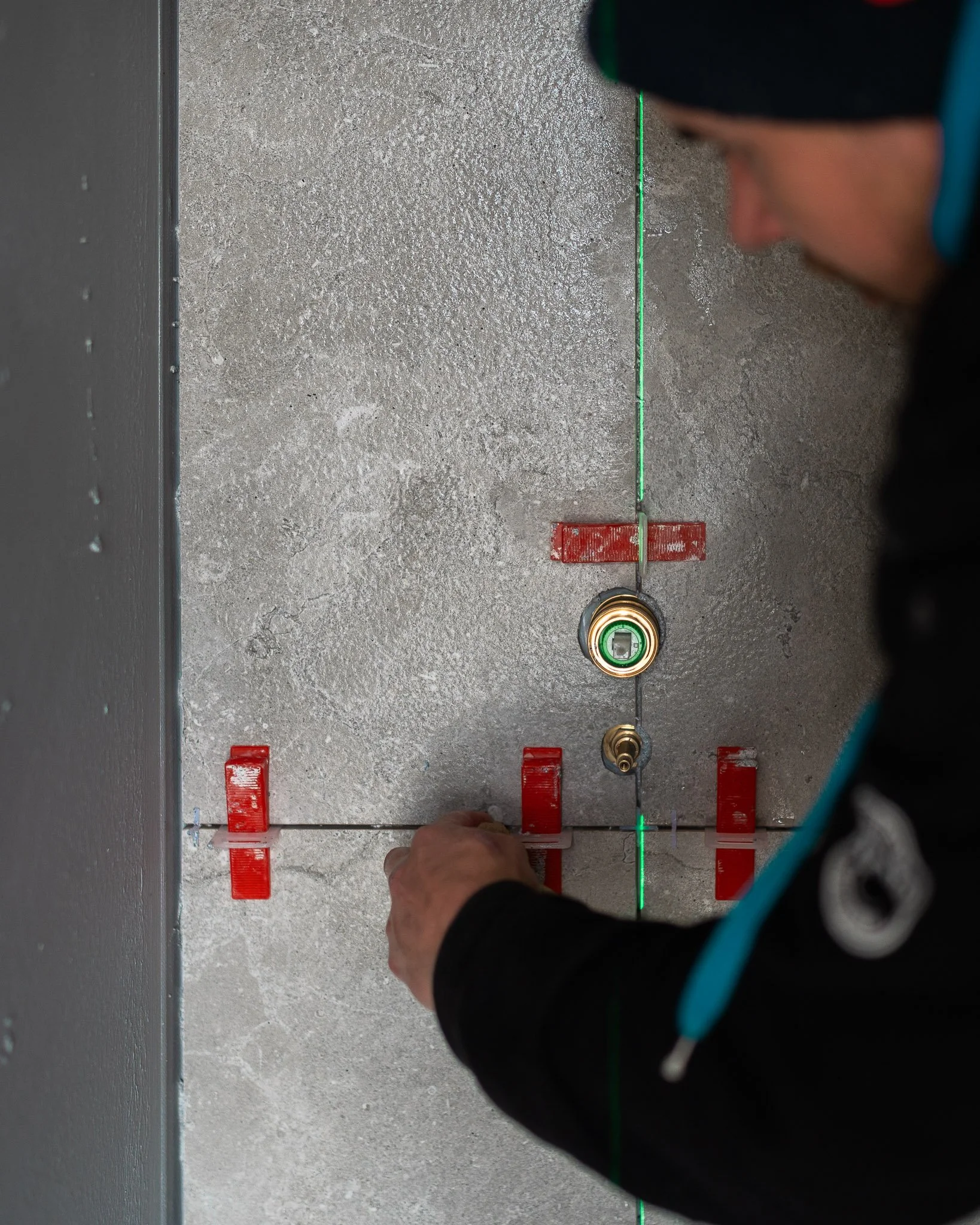

Over the past year, tightening market conditions have exposed a structural weakness across much of the construction sector, particularly among sub-trades that have historically relied on B2B workstreams. Plumbers, roofers, electricians, and other specialist trades that once benefited from relatively stable pipelines through main contractors have come under increasing pressure as pricing competition intensifies and tender margins compress.

Before examining why this pressure has been felt so acutely, it is worth clarifying what redundancy means in this context. In engineering, systems design, and risk management, redundancy is not inefficiency. It is more closely aligned with resilience. It refers to the deliberate inclusion of alternative pathways so that when one system fails or degrades, the whole structure does not collapse. As risk theorist Nassim Nicholas Taleb has observed, “Redundancy is ambiguous because it seems like a waste if nothing unusual happens. Except that something unusual happens, usually.” For construction businesses operating in cyclical markets, the relevance is clear. Demand sources contract unevenly, conditions change faster than businesses can adjust, and reliance on a single revenue channel increases fragility rather than efficiency.

As project volumes slow and builders become more cost-sensitive, competition has increasingly shifted toward price. Smaller operators with lower overheads have been able to undercut established businesses, forcing margins down to levels that are difficult to sustain. In many cases, sub-trades have continued to deliver similar volumes of work, yet overall turnover has declined, eroding profitability without reducing workload. The impact is often most severe for businesses that invested in people, systems, and infrastructure during stronger market conditions and are therefore less able to compete purely on price.

This margin compression creates a secondary problem that is less visible but equally damaging. As profitability tightens, discretionary spend is reduced, and marketing is typically one of the first areas to be cut. Businesses can find themselves operating at capacity while losing the financial flexibility required to adapt. There is little room to test new channels, reposition services, or invest in growth. The business remains busy, but increasingly constrained.

This dynamic highlights the vulnerability of a purely B2B operating model during downturns. Builder relationships remain essential over the long term, yet reliance on a single source of demand leaves businesses exposed when that source contracts. What has become increasingly clear is the value of a built-in redundancy, specifically the ability to pivot toward a B2C audience when conditions require it.

From a marketing perspective, this does not mean abandoning trade relationships or repositioning the business entirely. It involves ensuring the foundations exist to engage homeowners directly when necessary. That capability must be established in advance, as attempting to build it under pressure, when margins are already tight, is significantly more difficult and often less effective.

Homeowner decision-making differs materially from that of builders and designers. Lacking the technical knowledge and pricing benchmarks of industry professionals, homeowners tend to rely more on trust, clarity, and perceived alignment with their expectations. Quotes are assessed less through detailed scope comparison and more through confidence in communication, process, and reliability. For sub-trades, this requires a different narrative, one that explains services clearly and reassures clients about outcomes and accountability. In certain market conditions, this dynamic can also support stronger margin protection, as homeowners often place greater value on certainty and service quality, reducing the intensity of price-based competition seen in trade-led environments.

A business’s digital presence must be capable of supporting this form of engagement. This may involve reshaping website structure, introducing clearer homeowner-facing service pages, and developing content that speaks to lived problems rather than technical specifications alone. Search-driven channels such as Google Ads can then be used to capture existing homeowner demand, while longer-term investment in SEO helps build visibility over time. Unlike trade relationships, which are often awareness-based, homeowner demand tends to surface through direct search behaviour, making these channels particularly relevant during downturns.

The value of redundancy is not limited to periods of contraction. When market confidence returns and builder-led pipelines strengthen, the homeowner pathway should not be dismantled. Landing pages, content, and search visibility should remain in place, even if they are no longer actively promoted. This preserves optionality and reduces the time required to respond when conditions tighten again.

Establishing this redundancy does require investment. Content development, website changes, and advertising setup often require several thousand dollars upfront, followed by ongoing spend to remain competitive in established consumer markets. Introducing that level of expenditure when margins are already under pressure is far more difficult than maintaining a modest, ongoing allocation that can be scaled when required. This is why redundancy functions best as part of long-term planning rather than a reactive measure.